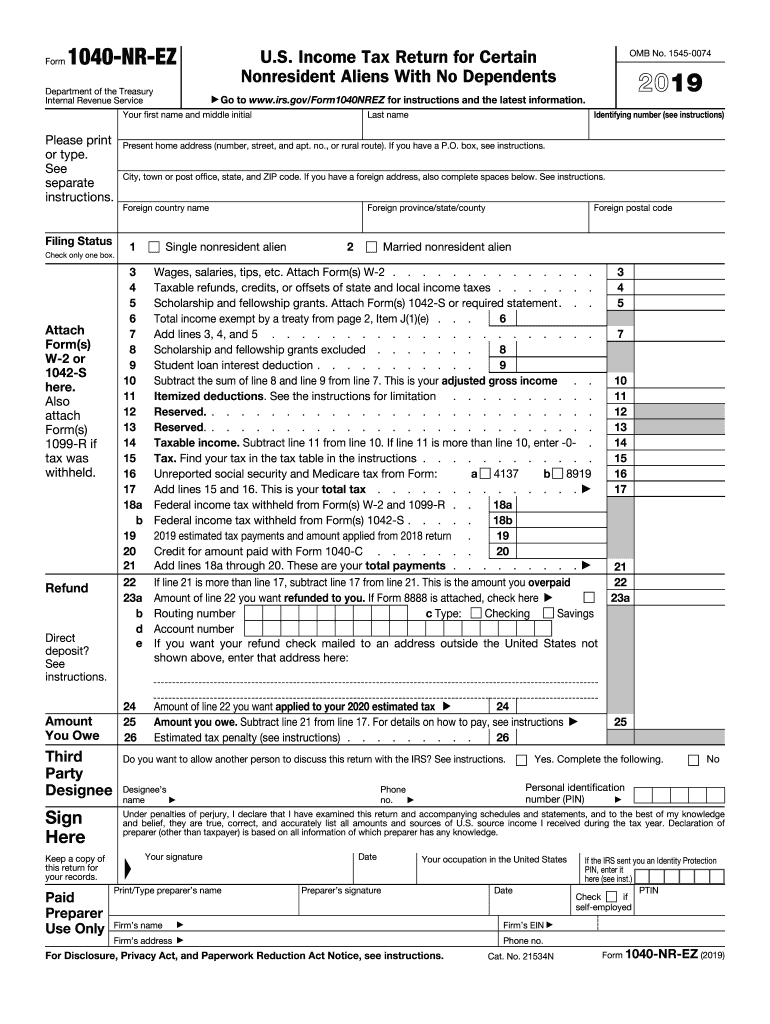

Sprintax will guide you through the tax preparation process, determining your tax-residency status, prepare the necessary documents, tell you which forms you need to complete, and check if you are due a refund. State tax return filing is offered at an additional cost paid by the student. SIUE has arranged access to Sprintax Returns with a code valid to file Federal 1040NR and Form 8843 for the current tax year.

The deadline to file your income tax return for tax year 2022 is Monday, April 18, 2023. (federal) tax return even if they do not have U.S. Tax Obligations All international students and scholars are required to file a U.S. International Students and Taxes Understanding Your U.S. School of Education, Health and Human Behavior.In other words, nonresident aliens with US income, regardless of amount, are required to file a 1040-NR. Unlike the 1040, there's no minimum income threshold for filing a 1040-NR. A person who has income from or participates in a US-sourced trade or business.Anybody who isn't a US citizen, US or Puerto Rico resident alien, or doesn't hold a green card.

In addition to those who don't pass the substantial presence test, nonresident aliens also include: Joe meets the first part of the test (at least 31 days in 2022), but fails the 183-day test:īecause Joe didn't meet the substantial presence test, Joe's considered a nonresident alien for federal tax purposes and can't file a 1040. You meet the substantial presence test, which means you were physically present in the US for at least 31 days in 2022 and at least 183 days in 2020 through 2022, according to this formula:Ģ022 days + (2021 days)/3 + (2020 days)/6 >= 183Įxample: Joe works three months (90 days) every summer as a camp counselor in the US.You're a nonresident alien married to a US citizen/resident alien with whom you'll file a joint return.You have a Permanent Resident Card ("green card").You're a resident of the US or Puerto Rico.If you're required to file a federal return for 2022, you can use Form 1040 (US Individual Income Tax Return) if any of these are true:

0 kommentar(er)

0 kommentar(er)